And check out the new paycheck planning feature in the premium version of EveryDollar. If you have an irregular income, you can still do this! Just put the lowest estimate of what you normally make in this spot. Repeat that process with all the income you (and your spouse, if you’re married) will earn in a month.Click the Planned amount and add in a planned dollar amount.Label the income as Paycheck 1, Paycheck 2, Side Hustle Money, or with your employer’s name-whatever works for you!.Here’s how you enter your income in EveryDollar: Income is any money you plan to get during that month-that means your normal paychecks and any extra money coming your way through a side hustle, garage sale, freelance work and the like. The first step to create your monthly budget is simple: Enter your income. You can create your budget in a spreadsheet, on a piece of paper, or the best way-with EveryDollar. When you create a monthly budget, you tell your money where to go so you’re never again left wondering where it went. Your monthly budget is just a plan for your money.

CREATING A PERSONAL BUDGET ARTICLE HOW TO

Ready to start? Let’s break down the steps and learn how to create a budget with EveryDollar.įirst, let’s start with a solid definition of budgeting. (You.)Īnd with EveryDollar, it’s way easier. It gives you permission to spend the right way-to show your money who’s in charge. But listen: The budget life is so worth it.īudgeting doesn’t tell you not to spend. People think budgets are hard, time-consuming and restricting. For more information about my personal finance writing services, contact me today.The word budget can get a bad rap. Visit Consumer.Gov to learn more about starting a personal monthly budget. Stick with it, and you’ll reap the rewards. Consistently staying within your budget is the most important part of meeting your savings goals.

Try not to overspend, and reevaluate your budget every month. Patience and persistence are important in personal finance. Allow yourself some flexibility so that you can better meet your needs and your goals. Sometimes your salary or living expenses change, and you must cut back on spending or start saving more money. You should make adjustments to your budget as needed. Your monthly budget does not have to be set in stone, especially when you are just starting out in your budgeting journey. Make sure that however you are spending and saving, have a plan for every single dollar you make. Following this rule is a good way to get your savings on track. Many people advise using the 50/30/20 rule. How much money should you set aside every month? It will be different depending on your salary and your goals. It may take time, but committing to saving money is worth it. Set money aside every month or every time you get paid to meet your financial goals. Do you want to save for retirement? A dream vacation? College for the kids? A downpayment for a home? Whatever you want for your future, you can plan for it in your budget.

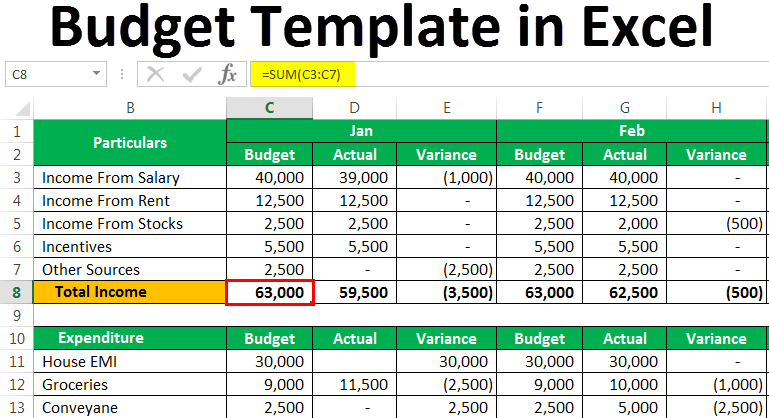

What do you wish to accomplish with your budget? Aside from keeping your bills paid, that is. Speaking of personal finance goals, it's time to set some. Choose the best option for you and your personal finance goals. There are also many different apps for personal finance and budgeting.īudget tracking can be as simple or complex as you like. A common method is to create a budget with Google Sheets or Excel. You can go old school with a simple pen and paper. These days, there are many different ways to track your income and spending.

Once you have your spending all laid out, it is easier to see where you can potentially cut costs. Include spending expenses like new clothes or eating out. This will include things like your rent or mortgage, utility bills, car payments, insurance costs, grocery bills, living expenses, and even things like paid subscriptions. Then, add up all of your monthly expenses. The amount of money you have after taxes is what you use for your budget. Things like alimony, child support, social security payments, or annuities should also be included. This includes hourly wages, salaries, commissions, and money earned from odd jobs or side hostels. The first thing you must do is add up all of your income. Here, I lay out 5 simple steps you can take to create your own personal budget. Thankfully, making a monthly budget is easy nowadays. Creating a personal budget to keep your finances in order is part of being a responsible adult. Unfortunately, sometimes we have to do things even if they are tedious or dull. I think we all know that adulting isn’t always fun.

0 kommentar(er)

0 kommentar(er)